Delta

When dealders sell us a contract they want to stay delta neutal.

1. When dealers sell the calls, bearish -> How to hedge? Buying the underlying.

2. When dealers sell the puts, bullish -> How to hedge? Selling the underlying.

Sum of delta (=. Net Preminums)

+ : bullish

- : bearish

Market DEX(Delta Exposure): If today's value is positive, tomorrow will probably be go up.

Ghost zone: minimal activity and presence by market makers.

Gamma

The amount of delta-hedging needed is mainly dependent on this thing called gamma.

Gamma shows the potential amount of delta-hedging activity by the market makers.

You are long gamma when you buy options and short gamma when you sell.

When the street is long gamma. Their delta-hedging activity forces them to “buy low, sell high”. They are sellers when the market rallies and buyers when it drops, conveniently adding liquidity and reducing volatility.

When the street is short gamma, the opposite happens. Dealers’ book is short options, and they “buy high, sell low”. This exacerbates market moves and removes liquidity (frequently, when it’s needed the most).

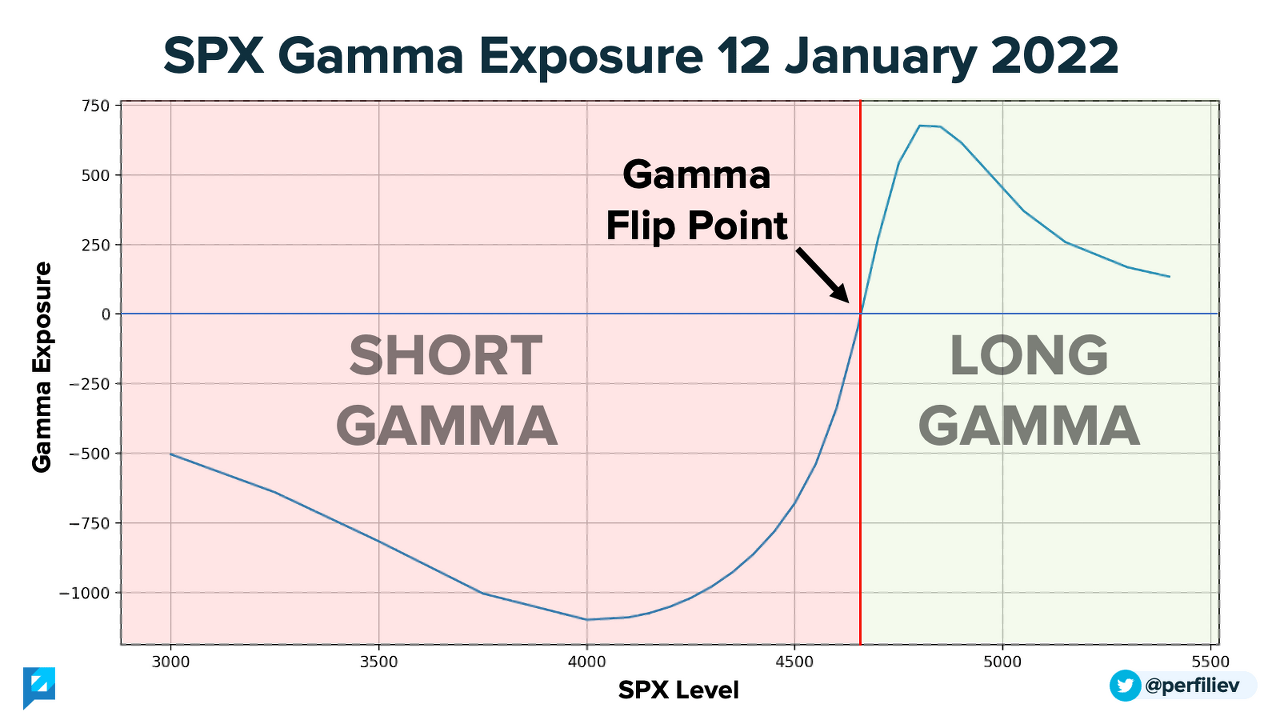

the street is short gamma on the downside and long gamma on the upside.

If we’re above the gamma flip, the volatility tends to be low. But should the market drop into negative gamma territory, expect fireworks.

In this scenario, delta-hedging flows move in the same direction as the market, potentially amplifying the price action. As volatility rises, systematic/managed volatility funds tend to cut exposure, further adding to the selling pressure and provoking more negative gamma flows.

Well, that depends on the available liquidity at the time. The higher the liquidity, the more likely the market will simply absorb any delta-hedging flows without even noticing it. However, at times of low liquidity, gamma flows can be responsible for significant price action around options expirations.

Gamma tends to lose its powers in a high volume environment, as delta becomes less sensitive to underlying moves. This is because short-dated options behave as longer-dated in a high volume environment.

자료 출처.

How to Calculate Gamma Exposure (GEX) and Zero Gamma Level - Perfiliev Financial Training

Are you tired from constantly living in the dark, fully unaware of the current Gamma Exposure? Are you frustrated from having to guess the Zero Gamma level ALL THE TIME? Are you annoyed from not knowing what the f*ck all of this even means!?! I know, I was

perfiliev.co.uk

'벌 궁리 > 투자분석' 카테고리의 다른 글

| 2024년 경제 전망 (4) | 2024.01.01 |

|---|---|

| CBOE SKEW (2) | 2023.12.31 |

| 투자 철학 #1 (0) | 2023.07.20 |

| 투자 철학 #2 (0) | 2023.07.20 |

| [트레이딩] Y23.CW20.불안한 횡보 (0) | 2023.05.15 |

댓글